Bitcoin ETF Outflows Reveal Market Weakness Behind Price Rally

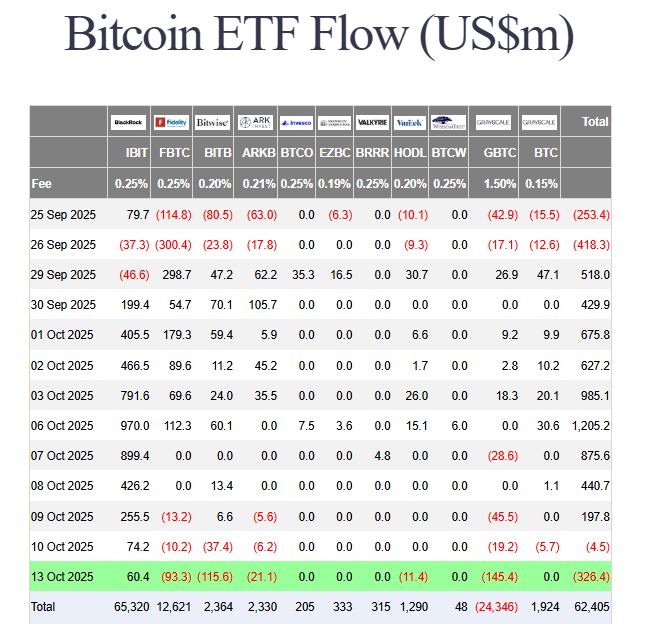

Bitcoin ETF Outflows have become the latest warning signal for investors as markets witnessed $326 million in withdrawals from spot ETFs on October 13, despite Bitcoin pushing toward $115,000. This divergence between price and institutional flows suggests a possible shift in sentiment — and a cautionary note for retail participants chasing momentum.

Why Bitcoin ETF Outflows Matter for the Market

Historically, large Bitcoin ETF Outflows indicate institutional profit-taking or defensive repositioning. When this occurs during a rally, it may reflect smart money distribution, where professional investors sell into strength while retail inflows keep pushing prices higher.

On October 13, nearly all major Bitcoin ETFs posted redemptions, highlighting a synchronized pullback across issuers. Yet, there was one exception — BlackRock’s iShares Bitcoin Trust (IBIT), which reported $60.3 million in net inflows and a staggering $4.7 billion in daily trading volume. This suggests not all institutions are exiting; some remain confident in Bitcoin’s long-term trajectory.

Institutional Sentiment Turns Cautious

The sharp outflows came just a week after over $5 billion in inflows, underscoring how quickly institutional mood can reverse. The shift coincided with renewed U.S. tariff tensions and rising market uncertainty following trade policy discussions under the Trump administration.

As a result, Bitcoin’s price slipped back to around $112,000, down 3%, while total trading volume dropped 18%. On-chain metrics show whales opening short positions on major altcoins including XRP, DOGE, and PEPE, reflecting a broader risk-off tone across the crypto market.

BlackRock CEO’s Take on the Bitcoin Landscape

Adding to the cautious sentiment, BlackRock CEO Larry Fink recently remarked that while crypto serves as a “diversification tool”, it should not become a major portfolio component. This moderation from the world’s largest asset manager signals a tempered outlook on near-term crypto exposure.

When leaders like Fink adopt a conservative stance, it often leads to ripple effects across institutional portfolios — potentially fueling additional Bitcoin ETF Outflows as risk tolerance narrows.

Price Up, Flows Down: The Classic Red Flag

When ETF flows and price action diverge, it’s usually a red flag. Rising prices alongside declining inflows typically point to retail-driven rallies with limited institutional backing.

In essence: price up, flows down = caution ahead.

Without renewed ETF inflows, Bitcoin’s current rally could lose momentum, leading to a period of consolidation or mild correction. Traders should track daily ETF flow reports to gauge whether institutional capital returns in the days ahead.

What Investors Should Watch Next

If ETF inflows rebound, it would indicate that institutions view recent weakness as a buying opportunity. However, continued Bitcoin ETF Outflows could signal that capital is rotating elsewhere — possibly into U.S. Treasuries, commodities, or stablecoin yield strategies.

For now, short-term traders may favor defensive positioning, while long-term investors could use upcoming dips for strategic accumulation.

Bitcoin ETF Outflows Demand Investor Attention

The recent Bitcoin ETF Outflows show that even during rallies, institutional players can quickly adjust exposure. This doesn’t necessarily spell a bearish reversal, but it highlights the need for vigilance and disciplined risk management.

To stay informed on institutional trends, investors can monitor live ETF flow data on Foresight News, CoinDesk, and Bloomberg Crypto — all DoFollow external resources.

For deeper insight into crypto portfolio strategy, explore related guides such as How to Build Your Stablecoin Yield Portfolio and Digital Infrastructure Trends by PrimeLayer Standard.